A critic’s guide to BitClout, this cycle’s most hated Bitcoin project

BitClout — a new social media platform for monetizing internet presence — seems to be thriving despite its haters.

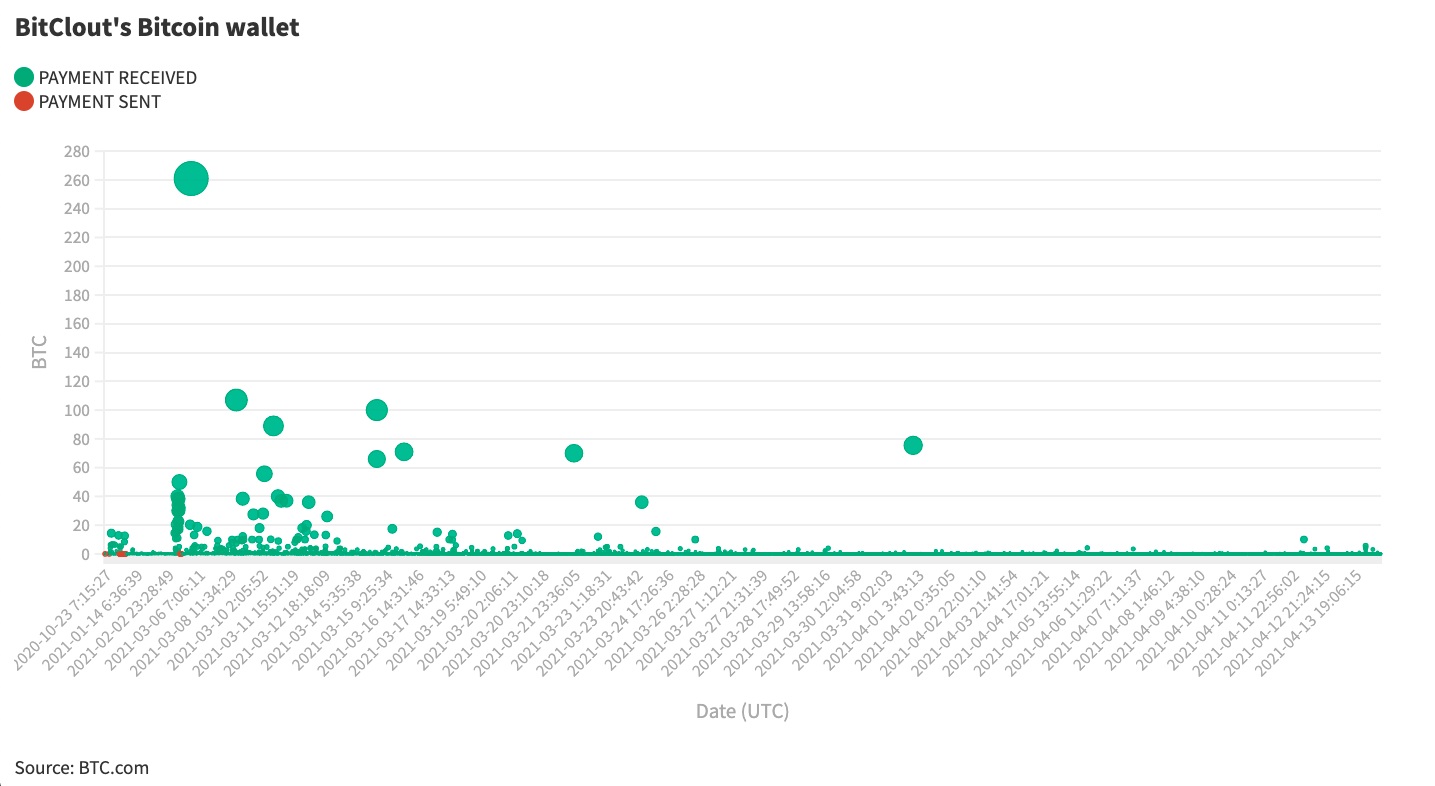

The platform’s operational wallet has now received over 4,100 BTC since it became active in October, representing over $260 million at current prices.

BitClout is believed to have generated all that Bitcoin by selling its utility token, also named BitClout, which powers the platform.

To become verified, users must tweet links to their BitClout profiles, ensuring the name appears in as many Twitter timelines as possible.

Grimier still, anyone can sell personal data (their phone number) for a small sum of BitClout, but to acquire more they need to buy it directly from the project’s website.

Critics say sleazy growth hacking tricks like these are red flags. But that’s BitClout’s entire shtick: monetize thinkfluencing.

BitClout is only useful inside BitClout

The price of BitClout is currently around $180 (according to its site), and there’s a bot on the platform tweeting updates (it reports new record highs nearly every day).

At current prices, that awards the token a market cap over $1 billion.

- BitClout says the price of its utility token doubles for every million it sells.

- Marketing materials claim 10 to 19 million BitClout tokens will be minted “in the long run.”

- This supposedly makes BitClout more naturally scarce — and more attractive — than Bitcoin.

The project’s API data shows about 8 million BitClout tokens have been minted so far, which suggests anywhere from 20-60% of the total supply remains to be sold. How much of those tokens were premined and sold to early investors is unclear.

And while BitClout’s blockchain does seem to exist, it appears to be powered by a handful of full nodes at best, likely controlled by insiders.

In any case, BitClout’s native utility token isn’t listed on price aggregators like CoinGecko. In fact, it’s not sold on any exchanges at all (even peer-to-peer) — which means BitClout sets the price and ultimately controls its circulation with an algorithm under its sole control.

There’s no way to withdraw them from the platform (no wallets support them anyway). Users can’t exchange BitClout back into Bitcoin to cash out, either.

And even if you could withdraw the token, it’s useless outside of the platform.

This is forcing buyers who want to offload unwanted BitClout into backroom Discord deals, where it sells for half its stated value, according to NY Mag.

Trade creator coins to acquire BitClout

BitClout’s utility token only has one function: buying so-called “creator coins,” which the platform automatically preps for every account that registers.

BitClout says the value of creator coins will rise as patrons buy them. Creators post, follow, like, and retweet others to drive interest in their coins, while speculators look to profit from their potential popularity.

Marketing materials even encourage traders to exploit the fickle ebb and flow of internet notoriety by buying and selling creator coins in a bid to acquire more BitClout.

“BitClout is hacking a social token network by appropriating Twitter profiles without consent,” said Joon Ian Wong, researcher in residence at social token ecosystem Rally. “It’s a nice growth hack but it doesn’t help create a real community.”

Instead, Wong explained, BitClout’s approach does the opposite: it only attracts financial speculators. “Platforms like Rally and Roll work with creators and issuers to insert a token into existing communities to align value,” he added.

Again, BitClout (and its creator coins) cannot be withdrawn and remain entirely useless outside the platform. So any “value” generated there is effectively moot.

While the price of BitClout is supposedly tied to how many units are sold, values of its creator coins are determined by what’s known as a “bonding curve” — a method of token distribution made popular a few years back.

In this model, prices of creator coins are tied to their supply. Both start at zero when BitClout profiles are created.

- Buyers lock their BitClout in creator profiles in exchange for creator coins.

- Creator coins are minted when bought, which increases their supply and price.

- Coins are destroyed when sold, decreasing their supply and price.

Creator coin holders are imbued with voting rights, message prioritization, and other minor incentives.

However, while BitClout touts that “value” is “locked” inside profiles in exchange for creator coins, cryptocurrency engineer James Prestwich recently discovered a glaring security flaw.

Turns out, the platform uploads private keys of users to its server almost every time they interact with it — meaning project insiders with access its servers can easily empty user wallets at will.

Al-Naji’s second rodeo

As with most sketchy crypto platforms, BitClout’s leadership and governance is frustratingly vague.

However, what’s clear is that Nader Al-Naji is spearheading the project — the entrepreneur behind failed algorithmic stablecoin Basis.

Al-Naji raised $133 million from some of Silicon Valley’s most prominent backers in 2018 to build a cryptocurrency powered by an algorithm to keep its price stable, rather than the dollar-backed stablecoins popular today.

But despite collecting cash from a veritable who’s-who including Andreessen Horowitz, Bain Capital Ventures, Lightspeed Ventures, and Google Ventures, Basis shut down and returned all the funds it raised. Al-Naji later cited insurmountable regulatory roadblocks for the move.

Now, in 2021, Al-Naji appears to be flouting rules and regulations all over again with BitClout, which is coincidentally backed by a number of the investors who contributed funds to Basis three years ago.

Prominent figures in the crypto industry have already sent cease and desist notices to Al-Naji for using their likenesses to market his tokens. Al-Naji responded by taking some of their profiles down.

Grant Gulovsen, a privately-practicing attorney who represents clients in the crypto industry, told Protos that BitClout “checks all the boxes” under the Howey Test, which is used by US regulators to determine whether an asset falls under their jurisdiction.

There’s investment of money: you have to buy BitClout to use the service. There’s common enterprise: investors share in the fortune of individual BitClout users. There’s expectation of profits from the efforts of others: neither BitClout or its creator coins are decentralized in any way.

“The fact that BitClout didn’t have a traditional ICO event doesn’t matter,” said Gulovsen, who described the platform as a centralized service masquerading as a decentralized network.

[Read more: SEC likely finds MetaKovan’s Beeple-backed crypto very ‘interesting’ — here’s why]

“Using the ‘Bahamas Test’ — if Al-Naji decided to take the Bitcoin and shut down the website, then holders would be [shit out of] luck,” Gulovsen added.

Companies selling securities to US investors must first register them with the SEC and provide regular financial statements.

Backed by crypto VCs

It’s easy to point to BitClout’s flaws and irregularities. However, it’s impossible to pretend the project hasn’t been financed by some of the crypto’s most important VCs in Sequoia Capital, Andreessen Horowitz, Coinbase, and Winklevoss Capital.

Their influence has drawn an influx of celebrities to BitClout, including Pamela Anderson, Tiffany Trump, Chamath Palihapitiya, and Jake Paul.

VC money does lend BitClout surface-level legitimacy. But that only holds weight when ignoring the history of out-of-touch VCs funding disappointing and questionable projects — not just in crypto but in tech more broadly.

As for how BitClout was able to attract so much money, Rally’s researcher in residence Wong posited “it’s entirely possible to attract lots of speculative capital up front and have little to show for it down the road.”

Truth is, it’s hard to say what the platform will amount to, and there’s a general belief that the controversies could work in its favor.

Speaking of the project’s insiders, Prestwich — the researcher who outed BitClout for its poor private key management — offered: “In all likelihood, they’ll succeed in getting legitimacy and make a boatload of money before BitClout fades away.”

Indeed, BitClout continues to attract Bitcoin in spite of its haters, having received nearly 28 BTC ($1.7 million) today alone.

Protos has so far linked at least 250 BTC ($15.8 million) sent from BitClout’s wallet to presumed crypto exchanges.