Here’s what Tether and Bitfinex must submit to NYAG this month

Coinbase’s recent listing of Tether (USDT) is generally considered a boon for the contentious stablecoin, but one glaring obstacle awaits — reporting to the New York Attorney General (NYAG).

In February, Tether’s iFinex and the NYAG settled to end a nearly two-year investigation into what the company actually uses to back USDT.

At the time, most focused on the slap-on-the-wrist $18.5 million fine for allowing New Yorkers access to USDT unlawfully. That figure now pales in comparison to the $50 billion in assets purportedly kept with iFinex’ bank in the Bahamas.

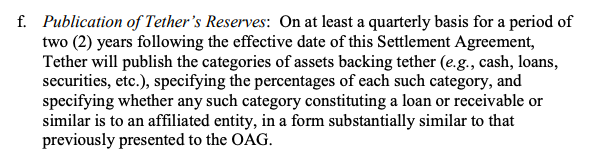

Indeed, the most interesting parts of iFinex’ settlement are rather the quarterly reports that Tether and Bitfinex must give the NYAG for the next two years:

- Documents substantiating Tether’s reserves (equivalent or more to the value of USDT in circulation).

- Proof of appropriate segregation of client and corporate funds (iFinex mixed them to hide $880 million in funds lost to an alleged fraudulent partner).

- Transfer disclosures between Bitfinex and Tether (to give transparency to their relationship).

A brief and tumultuous history of Tether

Bitfinex was founded in 2012 with the remnants of Bitcoinica, one of the first crypto exchanges to offer leveraged exposure to Bitcoin.

Raphael Nicolle initially led Bitfinex, whose history of spruiking Ponzi schemes was flagged by Ethereum’s Vitalik Buterin upon launch.

In 2013, Bitfinex was purchased by Giancarlo Devasini (CFO), Jean-Louis van der Velde (CEO), and Phil Potter (now former CSO).

For years, the industry considered Bitfinex and Tether separate entities. However, the Panama Papers in 2017 showed Bitfinex had acquired Tether and domiciled it in the British Virgin Islands under a parent org, Digfinex.

[Read more: Brexit’s top donor outed as Bitfinex, Tether parent shareholder]

Bitfinex has been hacked of user funds — twice. Tether, which once claimed to be regularly audited but has only offered attestations fraught with controversy, was also compromised in a cyberattack in 2017.

But those incidents didn’t necessarily bring regulatory heat to the Bitfinex/Tether/Digfinex web of companies.

What really caught the NYAG’s attention (and the Department of Justice) was the previously-mentioned $880 million frozen by multiple government agencies for ties to alleged fraud and money laundering.

The NYAG found Bitfinex lied about its knowledge of those funds and worked to hide the losses from the greater crypto market.

What to look for next month

The public-at-large expects some level of clarity in regard to Tether’s reserves.

Bitfinex already paid some attention to these concerns by sharing recent attestations by Cayman Islands-based Moore Cayman (formerly Kinetic Partners Cayman).

But such attestations only show the value of Bitfinex’ reserves (assets) outweigh the value of USDT in circulation (liabilities) at one particular moment.

NYAG’s settlement demands more thorough reporting. It requests the exact makeup of Tether’s reserves on a single day.

No doubt, Tether composes those reserves of cash, cash equivalents, digital assets, other assets, and/or gold.

The percentage held in those assets will either serve as proof of backing or fuel more questions — depending on how volatile they are.

Bitfinex is due to submit its documents within 90 days of its settlement (May 19). Authorities are expected to disclose them shortly after.

Those docs will offer a better glimpse of the composition of Tether’s reserves, but they alone won’t provide any real closure.

The underlying aspects to Tether that concern attorneys, accountants, and skeptics in the space will no doubt linger — particularly the provenance of Tether’s cash reserves and how often the value of Tether’s reserves fall below par.

A source familiar with Tether’s historic accounting practices told Protos the questions that will likely remain cover:

- Whether Tether uses its assets as collateral to secure additional funding.

- The precise terms of the receivables on Tether’s books.

- And the source of the assets backing USDT.

Numerous examples of how iFinex could use these unknowns to benefit were given.

They included (but were not limited to) “beneficial loan terms, manipulating receivables and liabilities to affect circulating supply, and the possibility of accepting illicit funds.”

To be fair, the source said, these issues aren’t unique to Tether but plague the entire stablecoin ecosystem.

They claimed the general public has been convinced that attestations and audits are almost the same, aided by auditors with “a mix of complicity and naivety when it comes to consideration of fraud and noncompliance with laws and regulations.”

Edit 16:12 UTC, May 9: Clarified Tether’s audit claims in paragraph 10, potential reserve asset classes in paragraph 18, due date in paragraph 20.