Tether Papers: This is exactly who acquired 70% of all USDT ever issued

If cryptocurrency was an engine, Tether (USDT) is one of its pistons.

Over the past seven years, the maverick stablecoin has evolved into a primary crutch for the ecosystem. It’s a tool for onboarding new money, managing and growing liquidity, pricing digital assets, and generally oiling crypto markets to keep them smooth.

Tether boasted a $1 billion market capitalization when Bitcoin hit $20,000 at the end of 2017. This year, it’s a $70 billion-plus powerhouse.

Practically every crypto exchange supports USDT trade in some form. The makeup of Tether’s reserves and its inner workings are yet to be disclosed in clear detail.

Still, the question of who exactly buys Tether directly from its parent company Bitfinex has remained unanswered since its inception way back in 2014.

Earlier this year, Protos shed light on that mystery by reporting that just two companies, Alameda Research and Cumberland Global, were responsible for seeping roughly two-thirds of all Tether into the crypto ecosystem.

Today, we reveal a lot more.

We’ve spent months cataloguing and investigating every single USDT ever sent to and from Tether, across the eight blockchains and layers on which it currently exists: Omni (Bitcoin), Liquid (Bitcoin), Ethereum, Tron, Simple Ledger Protocol (Bitcoin Cash), EOS, Solana, and Algorand.

Here’s what we found.

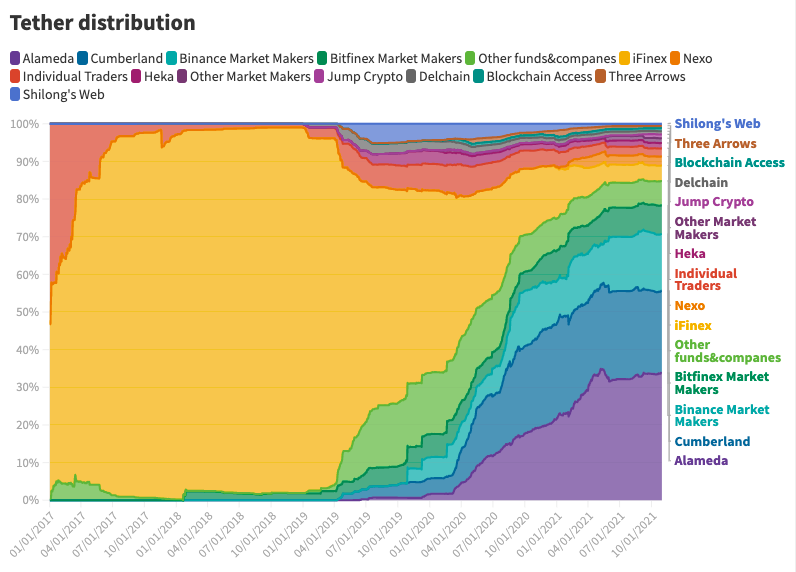

Birds-eye view of Tether

Protos pulled blockchain data from all disclosed Tether Treasuries and Printers across the various layers, stretching back to 2014 until October 31, 2021.

We then filtered out transactions between Printers and Treasuries, as our analysis is primarily concerned with USDT sent to and received from third parties.

After accounting for disclosed chain swaps (the process of transferring already-issued USDT between protocols), blockchain data shows Tether:

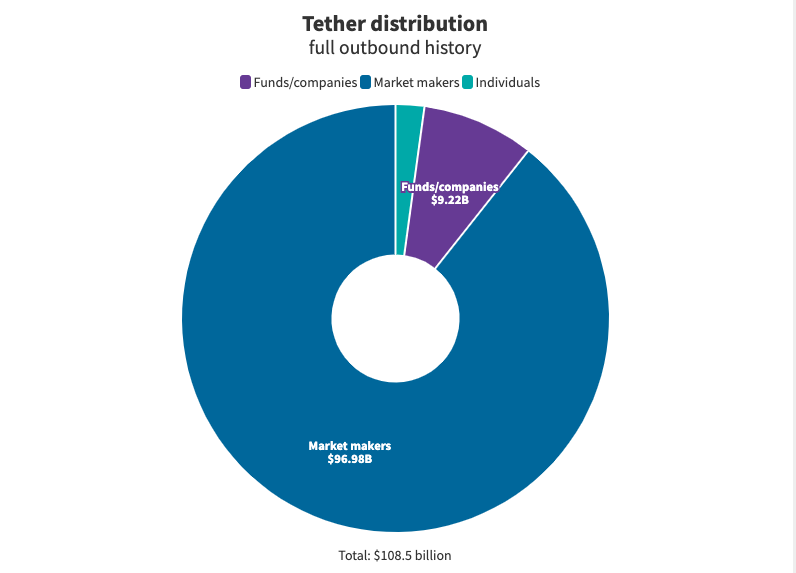

- distributed $108.5 billion in USDT,

- received $32.7 billion in USDT in that same period,

- sent a staggering majority of USDT directly to market makers and liquidity providers.

It must be noted that the figures cited in this analysis won’t always map one-to-one with Tether’s circulating supply.

Remember, we’ve tracked Tether Treasuries’ outflows and inflows; those volumes will not reflect Tether’s market value exactly (implying that Tether understandably recycles some USDT sent back to its Treasuries).

To make it clear: we’ve analyzed USDT flowing out of Tether Treasuries and linked blockchain addresses to specific entities.

Some of these entities maintain crypto exchanges; the data presented here relates specifically to their operational addresses as companies and not their exchange wallets, be they hot or cold.

Market makers, for our purposes, are simply defined as entities that have received multiple individual transactions from Tether Treasuries of $100 million USDT or more.

The term “market maker” traditionally refers to entities able to profit on the spread of assets (the difference in price between buy and sell orders).

Since it’s unclear which entities in the crypto ecosystem are strictly market making and which also utilize high frequency trading, proprietary trading desks, or operate venture capital funds, this is our attempt to delineate between them (albeit with a broad definition).

Within the context of Tether, market makers eke out gains by supplying crypto exchanges like Binance, Huobi, and FTX with liquidity for their various USDT trading pairs.

- Tether supplied categorized “market makers” with 89.2% of all USDT ($97 billion) it sent.

- Trading funds and other miscellaneous companies received $9.2 billion (8.5%).

- Smaller transactions deemed to have been received by “individuals” amounted to $2.35 billion (2.3%).

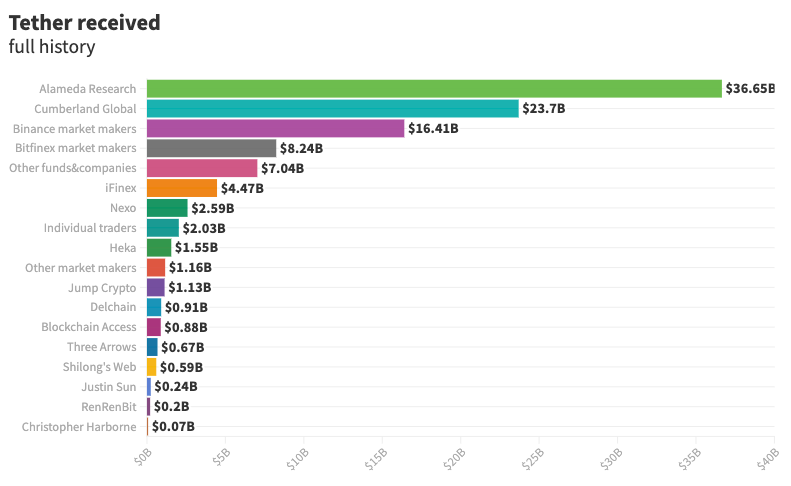

As Protos reported in August, market makers Alameda Research (spearheaded by crypto billionaire Sam Bankman-Fried) and Cumberland Global (a subsidiary of trading giant DRW) are still the biggest fish in Tether markets.

Together, Alameda and Cumberland received at least $60.3 billion in USDT across the time period analyzed, equal to around 55% of all outbound volume — ever.

$49.2 billion (71%) of Alameda and Cumberland’s USDT was acquired in the past year alone, equal to about 60% of all Tether issued in that time.

Market makers (Tether’s biggest customers)

Alameda Research

Alameda Research describes itself as a “multistage crypto and fintech investment firm,” and it made 29-year-old chief exec Bankman-Fried crypto’s richest billionaire (Forbes estimates his wealth at $26.5 billion).

Bankman-Fried founded Alameda Research in 2017 after leaving quant shop Jane Street. He opted to brand the fund a “research” unit to avoid banking problems as it started arbitrage Bitcoin trade in Japan.

The firm has historically been headquartered in Hong Kong, but recently announced plans to ship over to another tax haven, Nassau.

Read more: [Cashed-up crypto exchange FTX heads to Bahamas — closer to Tether]

Alameda Research wears multiple hats. It’s the parent company of crypto and crypto derivatives exchange FTX, but it’s also a quantitative trader, and serves as a venture capitalist across the ecosystem.

The firm has led an impressive 18 funding rounds and participated in 71 more, according to Crunchbase.

One of Alameda’s most notable moves was its participation in ‘Ethereum killer’ Solana’s $314 million token sale earlier this year, alongside Polychain Capital and CoinShares.

Alameda Research’s lead brain Bankman-Fried is one of Solana’s most vocal proponents. Solana’s native token SOL has since grown to become the fifth most-valued cryptocurrency at press time, just behind Tether.

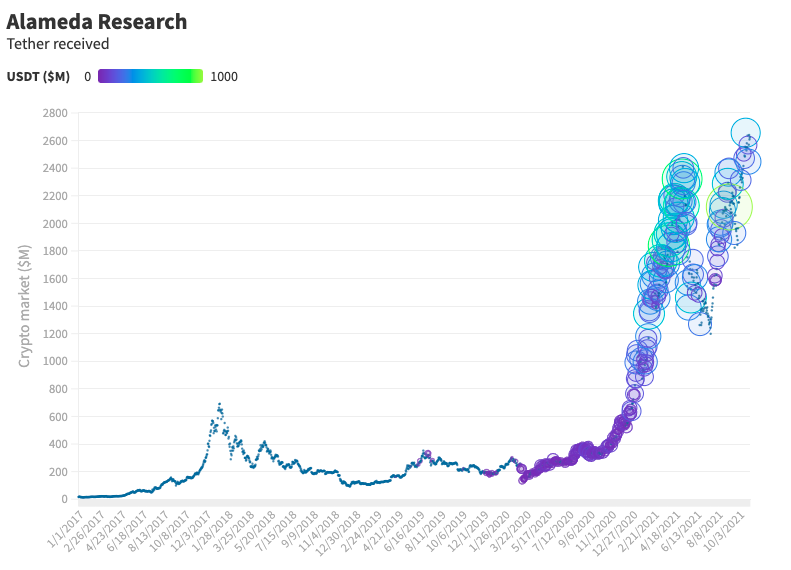

- Tether sent almost $36.7 billion in USDT to Alameda Research.

- $31.7 billion (86%) was received in the past year.

- Alameda Research accounted for 37% of all outbound volume.

While Tether sent nearly $30.1 billion (87%) of Alameda’s USDT directly to FTX, blockchain data shows Alameda operating on a number of other crypto exchanges.

Alameda also received:

- $2.1 billion (6%) on Binance,

- $1.7 billion (5%) on Huobi,

- $115 million (less than 1%) to OKEx.

The rest of Alameda’s Tether ($705 million, 2%) was sent to non-exchange addresses.

Cumberland Global

Cumberland Global is the crypto-trading subsidiary of markets powerhouse DRW, founded in 1992 by chief exec Donald R. Wilson.

As we reported in August, DRW is one of finance’s top dogs, particularly in futures markets (the Financial Times previously said the unit is “an important source” of futures trading volume across the globe).

Cumberland was first launched in 2014, during DRW’s gruelling five-year battle with the Commodities Futures Trading Commission (CFTC) over alleged market manipulation — which it won in 2018.

Cumberland says it onboards wealthy individuals and financial institutions to the crypto ecosystem.

One of those clients is VanEck. The US Securities and Exchange Commission visited DRW in 2019 to discuss the listing of VanEck’s SolidX Bitcoin Trust on Cboe.

VanEck’s Trust was eventually offered to institutional investors via over-the-counter desks like the ones DRW operates.

- Tether sent $23.7 billion in USDT to Cumberland.

- $17.6 billion (74%) was received in the past year.

- Cumberland received 22% of all outbound volume.

It has long been suspected, but Protos can confirm that Cumberland is one of Binance’s primary liquidity providers and market makers, and has been on the exchange since around early 2019.

Tether issued Cumberland $18.7 billion in USDT (79%) directly to Binance, and a much smaller amount to other exchanges:

- $131.5 million (less than 1%) on Poloniex.

- $9 million (less than 1%) on Bitfinex.

- $30 million (less than 1%) on both Huobi and OKEx.

The rest of Cumberland’s Tether ($4.9 billion, 21%) was sent to non-exchange addresses.

iFinex

iFinex is the mother company to its more well-known subsidiaries Bitfinex and Tether. The group has existed in the cryptocurrency space since 2013 and has survived three different hacks, regulatory scrutiny, and extended criticism from online commentators and mainstream media.

iFinex operates as a lender, exchange, stablecoin issuer, VC fund, and trading desk. It has a parent company, the Hong Kong-registered DigFinex.

It’s difficult to determine exactly which country iFinex, Bitfinex, and Tether operates out of: there are no actual offices. Instead, the organization is a mesh of shell companies located in the British Virgin Islands, Hong Kong, Switzerland, and other jurisdictions.

iFinex owners and shareholders seem to be the same individuals who launched it: chief exec JL Van der Velde and chief financial officer Giancarlo Devasini — the two-man team leading Bitfinex and Tether (both multi-billion dollar companies).

Chief technology officer Paolo Ardoino began working for the pair in 2016. Functionally, as the creators of Tether, they work with everyone who receives USDT.

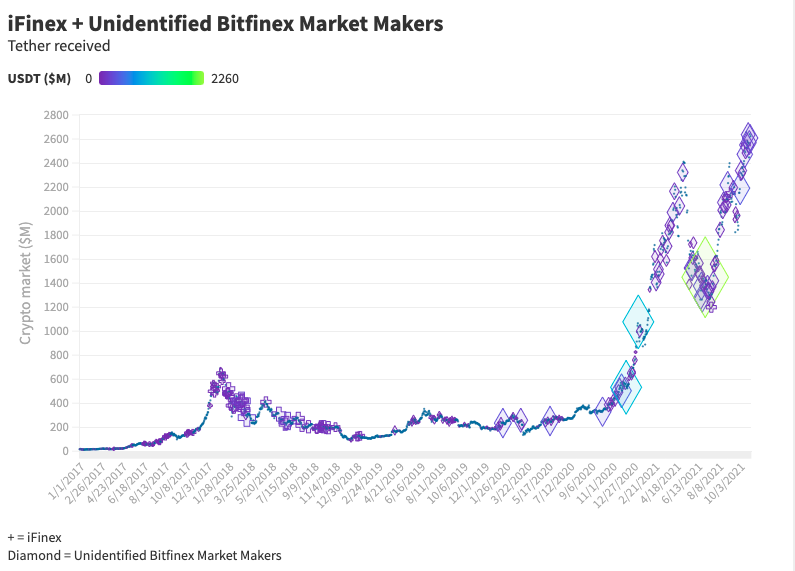

- Tether sent at least $4.5 billion in USDT to iFinex.

- Only $197.5 million (4%) of that was in the past year.

- iFinex received at least 4% of all outbound volume.

As to be expected, iFinex was one of Tether’s first true “market makers.” The Hong Kong-headquartered firm issued iFinex $4.5 billion in USDT between October 2016 and the start of 2020 — equal to 96% of iFinex’s trackable receipts.

- $4.46 billion (9.99%) was sent directly to Bitfinex.

- $1.1 million (less than 1%) was issued to wallets unrelated to Bitfinex.

- iFinex received at least 4% of all USDT issued across the time period analyzed.

iFinex and its subsidiaries have invested in several other ventures, including but not limited to Netki (a digital identity company) and Exordium (a video game company owned by Blockstream’s Samson Mow).

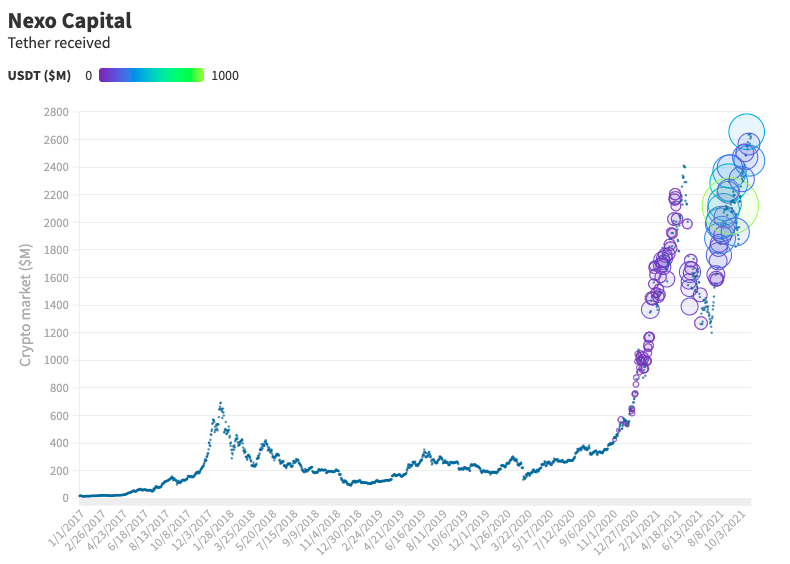

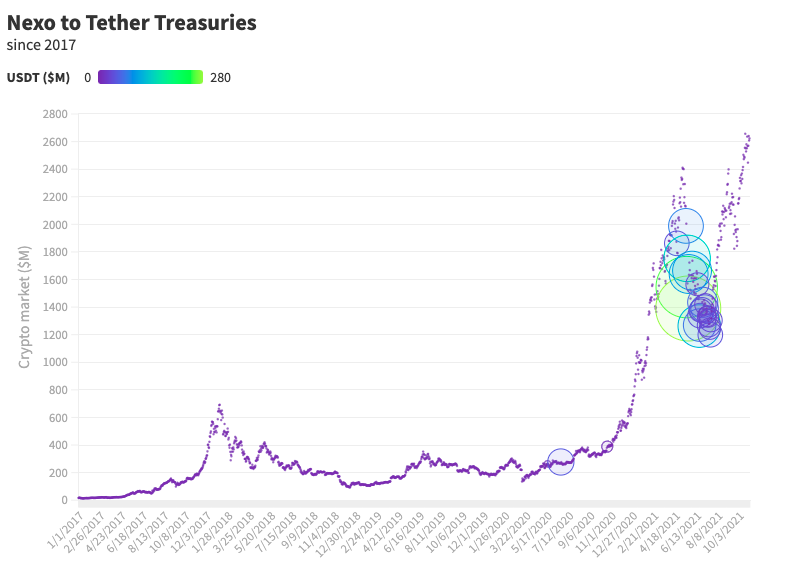

Nexo

Zug-registered Nexo is a sizable player in the DeFi ecosystem. It operates an exchange, a crypto lending service, and an over-the-counter trading desk.

Nexo’s crypto platform offers yield on a raft of cryptocurrencies, including stablecoins like Tether.

Nexo has been around since 2017, having deployed its own utility token NEXO in May 2018.

Understandably, Nexo handles large amounts of USDT to help manage its activities within the space.

- Tether sent Nexo $2.6 billion in USDT.

- Practically all of that was in the past year.

- Nexo received a touch over 2% of all outbound volume.

The group doesn’t issue directly to exchanges, instead relying on intermediary wallets to manage its USDT.

Nexo directed at least $1.7 billion USDT directly to its own platform, but similarly to Alameda Research, it is active across multiple exchanges.

As for where Nexo directs its USDT (these figures also include USDT inflows not directly from Tether Treasuries), the unit:

- sent roughly $1.45 billion in USDT to Binance,

- directed $111 million in USDT to Huobi,

- and deposited more than $57 million USDT to FTX.

Nexo also administered $39 million USDT to defunct Chinese exchange RenRenBit, and $84 million USDT to Bitfinex.

(NB: Nexo and other entities named in this research are known to handle funds on behalf of their clients. So, it could be that some of their outflowing USDT was processed for those parties.)

The firm sent roughly $35 million in USDT to addresses not linked directly to exchanges.

Last month, the New York Attorney General issued Nexo a cease and desist notice to stop it from offering services to crypto users in the state.

At the time, its chief exec Antoni Trenchev said the company had already initiated IP-based geo-blocking to keep New Yorkers out.

Heka

Heka is a market-neutral market maker operated by academics from the University of Malta and several other Maltese individuals. Specifically named in the Paradise Papers are Professor Simon Grima, Dr. Frank Dimech, as well as Joseph Xuerub and Adrian Galea.

The price per share to invest in Heka’s private fund is public and has increased by nearly 100% over three years. Minimum investment amount is $85,000.

Recently, Heka seems to be tied to Abraxas Capital Management — a company controlled by professional portfolio manager Fabio Frontini and based in London.

- Tether sent Heka more than $1.5 billion in USDT.

- $1.1 billion (71%) of that was distributed in the past year.

- Heka received about 1.5% of all Tether ever distributed.

Heka is primarily a cryptocurrency trading operation. So, naturally it requested Tether directly to the various exchanges it inhabits.

Overall, Heka utilized:

- at least $1.05 billion in USDT (68%) on Bitfinex,

- more than $144 million (9%) on Binance,

- and $132 million (8.5%) on Huobi.

Heka also traded on the no-longer-operational RenRenBit ($90 million, 6%), as well as the popular platform Kraken, where it received $60.4 million (4%).

Just over $70 million (4.5%) in USDT was sent to non-exchange addresses under Heka’s control.

Indeed, Heka moves hundreds of millions of dollars worth of Tether and yet they have no website, no way to reach out to them, and no real internet presence whatsoever.

The reason they’ve been flagged is their discoverability through the Paradise Papers. None of the individuals from Heka responded for comment.

Jump Crypto

Last September, Chicago-bound trading giant Jump Trading made a widely publicized crypto push by investing in decentralized exchange Serum, on Solana.

Serum and Jump had inked a deal for an undisclosed amount that would see the outfit provide the liquidity necessary to make Serum-powered platforms like Mango Markets usable.

Since then, Tether has issued Jump:

- at least $1.1 billion in USDT on Solana this year,

- equal to almost 99% of all USDT that exists on that blockchain.

- Jump Crypto is considered the top liquidity provider to Mango Markets and Solana overall.

Jump “officially” spun out its Crypto subsidiary this September.

At the time, press materials said Jump Crypto builds tooling and other software infrastructure for blockchains, as well as being an “active participant in trading and market-making activities that help make global crypto markets more efficient.”

While Jump’s crypto activities have been mostly undisclosed, reports indicate the unit has been particularly active on crypto exchanges Bitfinex and BitMEX.

This makes it likely that Jump makes up a considerable amount of the unidentified Tether amounts cited in this analysis, particularly those to Bitfinex.

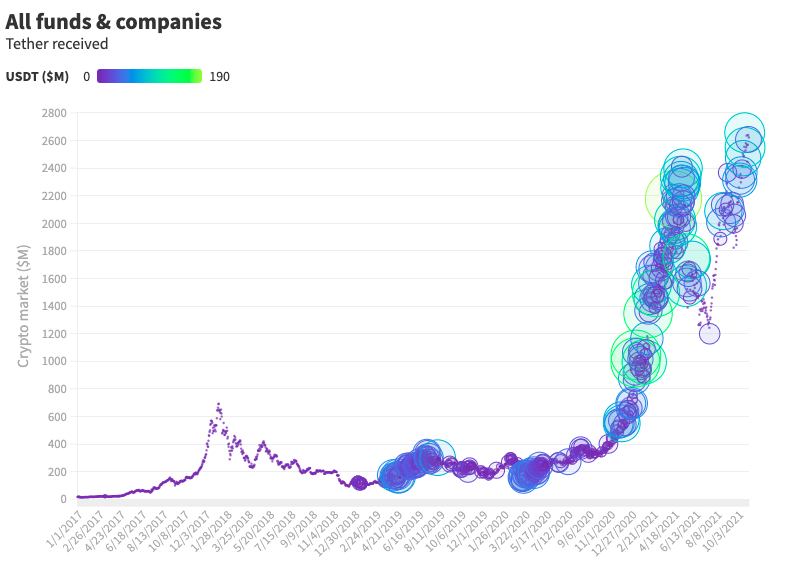

Funds and companies (Tether’s medium-sized customers)

Protos sorted entities into the ‘funds and companies’ bracket if they often received USDT transactions in lots between $10 million and $100 million at a time.

Many of the entities in this category are hedge funds and trading units, which generate profit by investing and trading cryptocurrencies.

Multiple entities maintain over-the-counter trading desks and other arbitrage units to exploit price differences between exchanges.

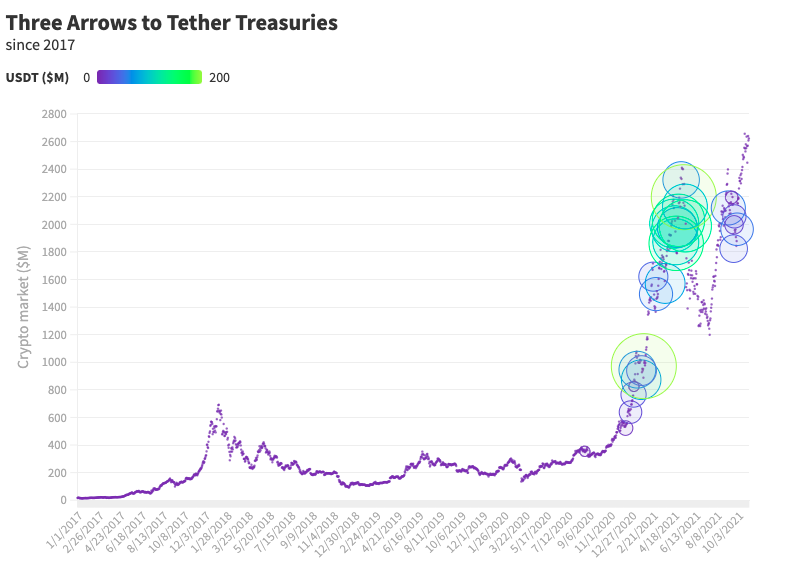

Three Arrows

Three Arrows Capital is run by popular crypto personalities Su Zhu and Kyle Davies. It has registered business addresses in both Singapore (where it maintains an office) and the British Virgin Islands.

As of 2020, the company had a large interest in the Grayscale Bitcoin Trust. The reason Three Arrows has two registered business addresses is likely due to the rule in Singapore that says it cannot control more than (S)$250 million ($183 million) in assets at any given time.

- Tether sent Three Arrows at least $674 million in USDT.

- At least $502 million (74%) of that was in the past year.

- Three Arrows has received at a minimum 7.3% of all USDT in the ‘funds and companies’ bracket.

Three Arrows describes itself as a crypto hedge fund that provides “risk-adjusted returns,” and it operates similarly to Heka.

The group mostly trades and invests in cryptocurrencies for profit, as opposed to the large-scale liquidity provision exacted by the likes of Alameda and Cumberland.

It also acts as a venture capitalist on occasion. Most recently, Three Arrows backed Sam Altman’s Worldcoin, a controversial biometric data-farming gambit that pays individuals to scan their irises for a small amount of cryptocurrency.

Read more: [Fuck Worldcoin, crypto’s Theranos fever dream cooked up in Silicon Valley]

Unlike Heka, Three Arrows receives USDT from Tether to an intermediary address before distributing it to trading platforms like Huobi and Binance.

Stablecoins aside, Three Arrows’ main address has mostly traded:

- Ethereum and Ethereum-bound Bitcoin (WBTC),

- DeFi platform Yearn Finance’s native token (YFI),

- Exchange tokens like FTX’s FTT, Uniswap (UNI), and SushiSwap (SUSHI).

Three Arrows has also handled significant amounts of yield tokens Compound (COMP) and Aave (AAVE), as well as blockchain oracle token Chainlink (LINK).

It’s worth noting that Three Arrows — like the other entities in this analysis — has handled significantly more than $674 million USDT in its history. The figures cited above only relate to the tokens it received directly from Tether Treasuries.

Three Arrows has also sent Tether Treasuries far more USDT than the figures listed here (more on that later).

Blockchain data also indicates that Three Arrows switched to receiving USDT directly to exchanges earlier this year — likely to Binance.

So, some portion of the “Binance Market Maker” volumes cited earlier almost certainly belongs to Three Arrows.

Bitquery shows that Three Arrows has collectively been sent billions in USDT from exchanges Binance, Bitfinex, and FTX, funds it acquires by trading digital assets.

Delchain

Delchain is a peculiar piece of the Tether puzzle. It’s owned and operated by Tether’s primary banking partner, Deltec Bank and Trust.

Paolo Ardoino, Tether and Bitfinex’s CTO, briefly served as a director, and Janvier Chalopin, the son of the Deltec Bank and Trust’s chief exec, is a director.

Delchain, though established in 2019, has still moved a significant amount of Tether and partners with many influential cryptocurrency companies, including Bitfinex, Kraken, and Tether itself.

- Tether sent Delchain at least $908 million in USDT.

- USDT was distributed steadily over time — 63% of it in the past year.

- Delchain received about 10% of all USDT from the ‘funds and companies’ bracket.

Overall, Delchain directed:

- About $694 million (76%) of its USDT to Bitfinex,

- $211 million (23%) to Kraken,

- and $3.2 million (less than 1%) to Binance.

Blockchain Access and RenRenBit

UK-based market maker Blockchain Access is another notable entity to have received large amounts of USDT directly from Tether.

Blockchain Access manages crypto exchange Blockchain.com — headquartered in Luxembourg. It received more than $881 million in USDT, with $679 million (77%) issued in the past year.

We tracked Blockchain Access’ USDT to crypto exchanges including Binance, FTX, Bitfinex, and Nexo. It has also handled significant amounts of Basic Attention Token (BAT), DeFi token Aave, as well as Chainlink, OMG Network, and Origin Network.

Lastly, RenRenBit. The Singapore-headquartered company that serviced the China-based exchange of the same name was issued over $200 million in USDT.

(NB: Bitfinex’s AML agent was once a Hong Kong firm “Renrenbee Ltd,” highlighting how close RenRenBit’s relationship was with Bitfinex).

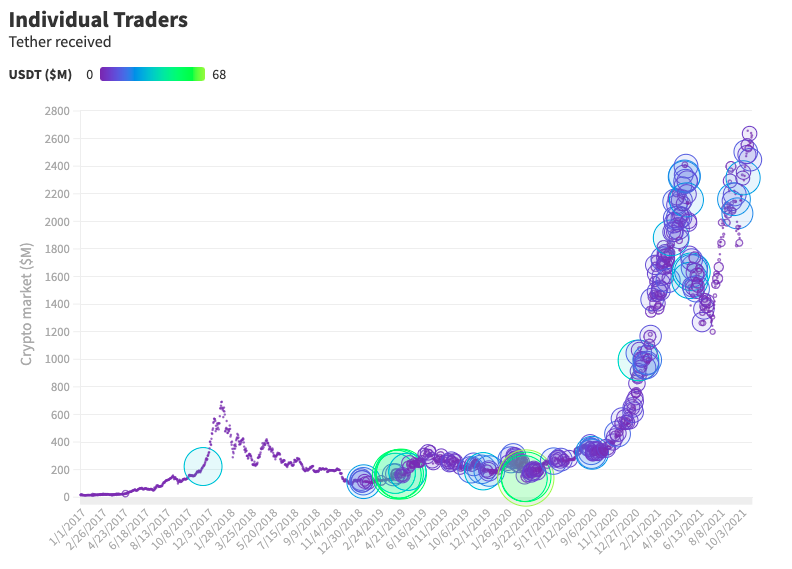

Individual traders (Tether’s smallest customers)

For our ‘individuals’ bracket, we considered entities to be individual traders if Tether issued them USDT valued under $10 million at a time.

This is obviously not perfect, however considering the volumes linked to aforementioned funds, companies, and market makers, this proves an effective method of separating crypto trading enterprises from individual crypto traders.

The first character on our list is tied to multiple companies, but according to information gathered by Protos, they also were issued Tether under their personal name.

Shilong’s Web, Tether’s most curious customer

Shilong Wang is a curiosity, to say the least. They appear, on the surface, to handle USDT for a raft of trading firms, including little-known managers Paretone Capital, Aoide Capital, Max Victory Wealth Management, and ZB Trade — registered to tax havens around the world.

Paretone and Aoide curiously share a physical address in San Jose, California at Hanhai Park. Their co-founder and chief exec is listed as a “Keke Wang” on Aoide’s website, who is noticeably absent from any corporate filings.

Protos visited Paretone and Aoide’s purported offices but found no mention of either firm on the building’s office guide.

We refers to Shilong-connected entities as “Shilong’s Web.”

- Tether issued Shilong’s Web $595 million in USDT.

- Roughly 1% of it was received in the past year.

- Shilong’s Web is responsible for 6.5% of the ‘funds and companies’ bracket.

It should be highlighted just how important a customer Shilong was to Tether. In the second half of 2019, Shilong’s Web represented over 5% of all USDT ever issued — just before the likes of Alameda and Cumberland took such a keen interest.

Shilong’s Web unexpectedly transacted semi-frequently with Cumberland Global:

- Shilong’s Web sent Cumberland $20.4 million in USDT between April and August 2019.

- Cumberland directed $1.14 million in USDT back to Shilong’s Web in April 2019.

- It’s likely Cumberland operates over-the-counter services for trading entities like Shilong’s.

Shilong’s Web deposited its USDT to exchanges like Huobi and Binance, but it was also responsible for sending over $108 million in USDT to long-serving Japanese exchange Bitbank.

Christopher Harborne (the Brexit Bankroller)

As we reported in April, Christopher Harborne made international headlines as Brexit’s bankroller.

He personally donated in total $19 million to political party Reform UK — the lead lobbying group behind the UK’s successful bid to leave the European Union.

Harborne’s web of shell companies were made public in the Panama Papers.

Harborne first appeared as a DigFinex shareholder (iFinex, Bitfinex, and Tether’s parent company) under his alternative Thai identity Chakrit Sakunkrit between 2017 and 2018.

This means Harborne was a DigFinex shareholder at the time of his donations to Reform UK. It’s common for individuals who do continued business in Thailand to adopt a local moniker.

He’s also the father of Will Harborne, chief exec of decentralized exchange DiversiFi, which started out Ethfinex, a sister company to Bitfinex. DiversiFi spun out from Bitfinex in 2019.

Protos can now reveal that Tether issued Harborne more than $70 million in USDT under his Thai name in early 2019.

TRON’s Justin Sun

Notorious marketeer and TRON founder Justin Sun has received more Tether than any other individual.

We first made Sun’s prolific Tether buying public in August. In total, he’s acquired at least $200 million in USDT. Most of the funds we’ve linked to Sun were sent throughout 2019 and 2020.

Sun received nearly $50 million in USDT directly on Binance. It’s likely he’s received a lot more to both unidentified wallets and various exchanges.

Sun was notably the first ever recipient of Tether on the TRON blockchain in April 2019. He’s evolved to become a prolific investor in NFTs and his exploits across the DeFi ecosystem have made him a popular crypto figure.

Blockchain data also shows he sent $120 million back to Tether Treasuries.

Tether returned to Treasuries (inflows)

Tether inflows — funds sent back to Tether Treasuries — are comparatively more difficult to track than outflows.

While Protos has identified more than 70% worth of USDT ever issued, more than 80% of USDT ever returned to Treasuries came from cryptocurrency exchanges.

This makes the sender of those transactions practically impossible to identify.

- $23 billion in USDT (62%) was returned in lots over $100 million (market makers).

- $12.7 billion (34%) was sent in batches between $10 million and $100 million (funds and companies).

- $1.5 billion (4%) flowed into Treasuries in sums under $10 million (individual traders).

We did manage to track USDT inflows for two prominent entities: Three Arrows and Nexo.

While Three Arrows did switch from having USDT issued to third party wallets to exchanges like Binance instead, it kept retrieving funds from various exchanges to its main wallet before returning to Tether.

- Three Arrows sent back nearly $1.96 billion in USDT in the time period analyzed.

- More than $1.1 billion (58%) was returned as crypto markets peaked between late April and May this year.

- Three Arrows is responsible for 5.2% of all USDT ever sent back to Treasuries.

As for Nexo, it followed similar patterns as Three Arrows — pulling funds back from the various exchanges on which it operates before returning USDT to Treasuries.

- Nexo sent $1.74 billion in USDT back to Tether Treasuries.

- Nearly $1.75 billion (94%) was returned between the second half of May and late July, 2021 (as markets bottomed out).

- Nexo was behind 4.7% of all USDT sent back to Tether Treasuries.

What the Tether Papers mean

It must be stressed that Protos is not explicitly alleging any wrongdoing on behalf of any of the entities detailed in this investigation.

But importantly, crypto traders on most exchanges should understand the sheer size of who they could be trading against.

The exact size of market makers like Cumberland and Alameda — as well as funds like Heka, Three Arrows, and Delchain — are previously unreported.

These entities are undoubtedly dominant forces across multiple platforms, with the ability to easily out-trade smaller crypto investors.

Numerous other large and unnamed trading funds have acquired hundreds of millions of dollars in USDT. These companies are mostly registered to tax havens like the British Virgin Islands, Hong Kong, and the Seychelles.

Some, similarly to Shilong’s Web, have sent and received USDT from major players like Cumberland Global, while others assisted prominent projects such as Decentraland to manage Ether raised throughout their ICOs.

The total value of the Tether in the ‘other funds and companies’ bracket exceeded $7 billion. Protos will reveal information about these companies in future investigations.

Still, we emphasize that Tether has indisputably embedded itself within the crypto ecosystem, and for better or worse, serves a purpose within it.

So, it stands to reason that any firm or individual who operates within the crypto space is likely to interact with USDT at some point.

It’s worth highlighting that funds like Three Arrows effectively make use of the Tether they receive, as proven by inflow patterns.

Three Arrows was able to acquire USDT in the leadup to a giant crypto bull run, and then return those funds as the market was cooling off.

This shows that USDT can be utilized for profit — as it should. It is the leading stablecoin, and allowing traders a neutral zone to trade in and out of their crypto positions is its entire business model.

Read more: [Inside the Great Pie Chart giving Tether its dollar value]

But the exact workings of Tether are unclear. Quite literally, nobody knows precisely how Tether operates — or which companies’ commercial paper make up an overwhelming majority of its assets backing USDT.

We understand that Tether lends out its USDT in overcollateralized loans, likely for Bitcoin and Ether, but Tether has never formally disclosed how those operations work.

In fact, Tether has gone out of its way to obfuscate the services it provides to the crypto industry.

Discounts for large issuances are rumored. In our research, we are yet to find any confirmation of any discounts for USDT purchases.

But what is proven is that Bankman-Fried’s Alameda Research and Cumberland Global are two prolific Tether buyers that trust USDT is valued correctly.

Together, they’ve acquired at least $60 billion worth of USDT in the past two years. They inject liquidity into the ecosystem’s leading exchanges based on their trust in Tether, which in turn provides markets with the confidence that 1 USDT is equal to $1.

Whether that’s true all the time — unfortunately nobody knows for sure.

Regardless, Cumberland and Alameda, and to a lesser extent units like Jump Crypto, believe every USDT is always “fully backed by Tether’s reserves,” and that Tether has enough cash on hand to service dollar redemptions.

In the time between the end of Protos’ data analysis (October 31 until today), Tether has printed more than $4 billion worth of its stablecoin, bringing the total USDT in circulation to nearly $75 billion.

Follow us on Twitter for more informed crypto news. Got queries about the Tether Papers? Read our FAQ.

Edit 18:01 UTC, Nov 11: Corrected transaction dates between Shilong’s Web and Cumberland.